The Intersection of Data Analytics and Managerial Philosophy in Professional Hockey

By: Bracton Abella

Chapter 1- About the Author

My name is Bracton Abella, and I am honored to share this work with you. Hockey has been a defining part of my life, shaping not only my career ambitions but also my identity. From my earliest memories of watching NHL games to the countless hours spent analyzing every facet of the sport, my passion for hockey has fueled a journey driven by curiosity, discipline, and a relentless pursuit of understanding. This passion took root early—long before formal education entered the picture. I began my journey into hockey research in middle school, spending time exploring statistics, studying game footage, and creating my own methods to quantify what I saw on the ice. This work included creating detailed spreadsheets to track player performance, experimenting with rudimentary statistical models, and manually calculating trends that hinted at broader patterns in the game. While my methods were basic at the time, they laid the groundwork for what would eventually become a sophisticated system of interconnected metrics. What started as a personal interest evolved into a comprehensive framework for understanding the game, setting the stage for the academic and professional achievements that would follow.

My decision to attend Seton Hall University proved to be a good one, as it provided the perfect environment to bring this early work to life and push it to the next level. My time there was transformative, as it offered the tools, resources, and mentorship needed to refine my ideas and turn them into actionable insights. Through coursework in statistics, data visualization, and advanced analytics, I gained the technical expertise required to address the complex challenges in hockey analytics. Seton Hall also provided opportunities to test early iterations of the Advanced Bracton Score, comparing its outputs to real-world hockey data. This work is further strengthened by a dataset spanning 17 NHL seasons, from 2007-08 to 2023-24, ensuring that the conclusions drawn are robust and grounded in a comprehensive analysis of historical trends and performance metrics. My studies not only validated my methodology but also allowed me to refine the AB system by incorporating techniques such as regression analysis to assess predictive accuracy and clustering algorithms to identify patterns in player and team performance. Completing these projects for course credit, as well as independent work, not only expanded my skill set but also gave me the structure to formalize the research I had been developing since middle school. While at Seton Hall, I was able to connect my lifelong passion for hockey with cutting-edge academic knowledge, creating a foundation for meaningful contributions to the industry as a whole.

I graduated from Seton Hall in May 2024 with a Bachelor’s in Sports Management and Business Management. I am currently on track to earn my Master’s in Business Analytics by May 2025 from SHU as well. This combination of academic rigor and personal passion has allowed me to develop innovative analytical tools that revolutionize decision-making in hockey. Today, my work reflects not just my education but the culmination of a journey that began years ago, driven by an enduring love for hockey and a commitment to advancing the game through data and insight.

Beyond the numbers, my journey has been enriched by opportunities to engage directly with the sport. As a Hockey Film Analyst for SUNY Cortland, I spent countless hours dissecting games, seeking patterns, and generating insights that would aid the coaching staff in decision-making. This role underscored the importance of bridging the gap between raw data and actionable strategies on the ice.

At Sports Management Worldwide (SMWW), I honed skills in NHL scouting, agent representation, and negotiation, deepening my understanding of the business side of hockey. These experiences taught me how every decision—from player recruitment to contract negotiations—must be informed by data, intuition, and a nuanced understanding of the sport. As a graduate of the Hockey GM & Scouting and Hockey Agent courses, I am proud to be a lifelong member of the SMWW Alumni community.

The product of these experiences is Hockeyfreeforall.com (HFFA) and the Advanced Bracton Score (AB) family of metrics, a pioneering framework for hockey analytics. Over nearly a decade, I’ve built a comprehensive system that integrates statistical rigor with practical application, creating a toolset that is transforming how organizations evaluate talent, construct rosters, and achieve sustained success. The integration of Python into this process was a turning point, enabling deeper insights and more advanced analyses. Similarly, visualization tools have helped to illustrate the relationship between player movement and team dynamics, offering actionable insights for decision-makers.

My journey reached a significant milestone in October 2023 with the creation of the academic research study, Beyond Traditional Metrics: The Advanced Bracton Score and Hockeyfreeforall.com Paradigm for Informed Organizational Decision Making in Hockey, which laid the foundation for the AB family of metrics and demonstrated their practical applications across various facets of hockey operations.

Before delving into the detailed analysis, it’s crucial to highlight several key issues that will be recurringly addressed throughout this work. This report aims to comprehensively cover various facets of hockey operations, including General Management, Scouting, Coaching, and Agency relationships. As I approach the completion of my MBA, my primary goal is to secure employment where I can apply the insights derived from this research.

It’s important to underscore that the principles and methodologies discussed here are not confined to the National Hockey League (NHL) but are equally applicable to all levels of hockey. The hockey landscape at lower levels—ranging from minor leagues to collegiate or junior hockey—often lacks sophisticated statistical analysis that is more commonplace in the NHL. This gap presents a significant opportunity for the implementation of my research. Here, the insights could revolutionize how teams approach talent scouting, player development, game strategy, and even financial management.

For instance, GMs can use advanced analytics for strategic decisions regarding player acquisitions, cap management, and long-term team planning. Scouts could leverage enhanced data models to identify undervalued players or predict future performance with greater accuracy, offering a competitive edge in draft selections or free agency. Coaches could benefit from data-driven insights to tailor training programs, strategies, and player rotations to maximize team performance. Moreover, player agents can use detailed performance metrics to negotiate better contracts or guide their clients’ career paths more effectively.

The lower tiers of hockey offer untapped potential for these methodologies due to resource scarcity, where smaller budgets and fewer personnel mean that data-driven strategies could be a game-changer, allowing these teams to compete more effectively. Early adopters in these leagues could establish new standards, potentially leading to broader recognition and success. With less sophisticated competition, the impact of improved statistical analysis on player and team development could be even more pronounced.

It is also important to note that the lack of formal citations throughout this work is intentional. Unlike traditional academic research, which builds upon prior studies, the concepts, methodologies, and frameworks developed here are entirely original. This work is the product of independent thought and innovation, as comprehensive analytical models of this nature do not currently exist in hockey. The source data used throughout this analysis is exclusively mine, gathered through years of research and refinement. However, I have acknowledged the websites and resources that contributed to the data collection process in the Acknowledgements section.

The principles outlined in this report are designed to be flexible and scalable, offering endless opportunities for innovation at all levels of hockey. However, I want to emphasize that this analysis reflects my perspective on hockey analytics—I do not claim to have all the answers. I am eager to work within the industry, learn from established traditional methods, and refine my approach through experience. That said, I believe having a well-defined philosophy on the game is essential in this field, setting analysts like me apart from the average fan. With that being said, let’s get started!

Chapter 2- Introduction

The Advanced Bracton Score (AB) is not merely a numerical system; it is a transformative philosophy that redefines the way hockey organizations approach decision-making. At its core, the AB Score operates on a simple yet profound premise: minimizing mistakes leads to more wins. This guiding principle underpins the entire framework, which is designed to quantify intangible elements such as intelligence, discipline, adaptability, and situational awareness. By capturing these qualities, the AB metrics provide a multidimensional view of player contributions, coaching effectiveness, and organizational success—offering insights that expand beyond traditional statistics. This framework has demonstrated remarkable predictive power across multiple dimensions of hockey performance and success. Key findings include:

- Longevity and Team Impact: Players with high AB scores are consistently found to have longer NHL careers, more sustained contributions, and a greater impact on team performance. These players often serve as the backbone of successful rosters, providing stability and leadership.

- Championship Teams: A deep analysis of championship-winning teams reveals a common theme—rosters with a high ratio of positive AB players. These teams leverage the qualities captured by AB metrics to achieve success under the pressures of playoff hockey, where mistakes are most costly.

- Pre-NHL Evaluation: Metrics such as the Tentative AB (TAB) Score offer actionable insights into a player’s likelihood of NHL success, even in later draft rounds. TAB helps scouts identify “diamonds in the rough”, ensuring that teams can uncover hidden potential and make the most of their draft capital.

- Organizational Excellence: Teams and organizations that adopt AB principles—whether in drafting, coaching, player development, or general management—consistently outperform their peers. By aligning decision-making processes with AB insights, these organizations build competitive advantages that translate into sustained success both on and off the ice.

The Advanced Bracton Family of Metrics is not limited to player evaluation; it is a comprehensive toolset that supports every facet of hockey operations. Coaches can use AB metrics to tailor strategies to their team’s strengths while minimizing weaknesses. General managers can leverage the insights to optimize roster construction, salary cap management, and trade negotiations. Scouts can incorporate Tentative AB (TAB) metrics to uncover previously overlooked talent, combining these insights with traditional scouting methods to enhance the overall quality and precision of player evaluations. Agents can apply AB data to negotiate fair contracts and maximize their clients’ value, while teams can use arbitration metrics to ensure equitable outcomes in disputes.

The true significance of this research lies in its universality and adaptability. While its foundations are deeply rooted in hockey, the principles of mistake minimization, adaptability, and efficiency apply to any competitive or decision-driven environment. Whether in sports, business, or other high-stakes industries, the Advanced Bracton Score offers a framework for identifying and leveraging key contributors to success.

Moreover, this structure represents a paradigm shift in how we evaluate performance, moving beyond traditional box scores and rudimentary analytics. It embraces a more nuanced, comprehensive approach to understanding the human and organizational factors that drive success. The Advanced Bracton Score is not just an analytics system—it is a philosophy of winning, a roadmap for sustained success, and a testament to the power of combining rigorous data analysis with deep practical understanding. This holistic approach positions the AB Family of Metrics as an indispensable tool for any organization seeking to excel in hockey or any other competitive field.

The Birth and Evolution of HFFA

The path to developing the AB family of metrics has been one of evolution and refinement. It began with a simple question: How can we quantify the elements that truly make a difference in a hockey game? The journey has encompassed years of education, research, and professional experiences, each contributing to the development of a system that is as practical as it is rigorous.

In 2015, I launched Hockeyfreeforall.com, a platform to share insights and foster discussion about hockey analytics. What began as a small project has grown into a comprehensive research hub, featuring over 250 articles. The development of the Advanced Bracton Score emerged from this work, driven by a desire to create a metric that could capture the nuances of hockey performance.

Over time, the AB Family of Metrics has evolved into a comprehensive system encompassing multiple dimensions of hockey analytics. This system includes Replacement Level Player Analysis, which quantifies player value compared to baseline performance; Tentative AB Scores (TAB), designed to predict NHL success for junior and pre-draft players; Coaching and General Management Metrics, which evaluate the impact of leadership decisions on team performance; and Arbitration and Agency Analysis, providing tools for salary negotiations and contract efficiency evaluations.

The integration of Python and other data analysis tools has further elevated the capabilities of this system, serving as a transformative addition to the research process. These enable more advanced methodologies, such as regression models to validate the predictive accuracy of AB metrics, clustering algorithms to uncover trends in player and team performance, and visualization tools to effectively communicate complex findings. By leveraging Python’s analytical power, the research has not only increased its rigor but also revealed deeper insights into the interconnectedness of the AB Family of Metrics. This enhanced integration ensures that each component complements and reinforces the others, creating a cohesive framework for driving informed decision-making in hockey.

Connecting the Research Points

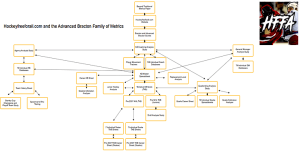

The Advanced Bracton Family of Metrics (ABFM) operates as an interconnected ecosystem, with each component contributing to a broader understanding of hockey analytics. At the heart of this system is the AB Master Spreadsheet, a meticulously designed repository that integrates both raw and processed data. This centralization not only ensures consistency across all analyses but also facilitates a seamless flow of information between specialized studies such as Replacement Level Analysis, Goaltending Metrics, and other key components of hockey operations. The flowchart titled The Advanced Bracton Family of Metrics: An Interconnected Framework for Hockey Analytics visually represents these connections, underscoring how each part of the system builds upon the others to create a cohesive and comprehensive analytical framework.

Each component of ABFM was developed through an iterative process during my time at Seton Hall University, where I combined my academic coursework with practical application. The foundational idea of creating a master spreadsheet stemmed from the need to organize and analyze large datasets efficiently, a skill honed through courses in advanced analytics and data visualization. Once the AB Master Spreadsheet was established, it became the backbone for subsequent projects, enabling targeted explorations into distinct areas of hockey performance.

For example, the Replacement Level Player (RLP) Analysis was one of the first major offshoots of this system. RLP Analysis quantified player value by comparing individual performance to league-wide baselines. This project highlighted the importance of establishing consistent benchmarks, which later informed the development of AB-centered Goaltending Metrics. Similarly, early insights from RLP studies revealed gaps in understanding how pre-NHL organizations contributed to player success, prompting the creation of the Tentative AB (TAB) Score to evaluate junior and pre-draft players.

Throughout this process, each new project refined and expanded the scope of the ABFM. The Coaching AB and General Management AB metrics emerged as natural extensions, drawing from player-level analyses to assess the broader impact of leadership decisions on team success. The interdependence of these metrics was key—data from the AB Master Spreadsheet provided the foundation for analyzing coaching impact, while findings from Coaching AB studies informed refinements in player evaluations. Likewise, General Management metrics leveraged the same central dataset to evaluate decision-making efficiency in trades, drafts, and salary cap management.

By blending advanced coursework with independent research at Seton Hall, I was able to create a system where each metric enhanced the others, resulting in a cohesive ecosystem that not only evaluates individual players but also informs team-level and organizational strategies. Each project built on the lessons learned from the previous one, creating a continuous cycle of improvement that remains the hallmark of the Advanced Bracton Family of Metrics as depicted in the graph below.

Introduction Conclusion

This paper represents a natural progression and significant expansion of the foundational work established in Beyond Traditional Metrics: The Advanced Bracton Score and Hockeyfreeforall.com Paradigm for Informed Organizational Decision Making in Hockey. While the previous paper laid the groundwork for introducing the Advanced Bracton Family of Metrics, this study builds upon that foundation by expanding on those ideologies in a more data centric manner. By exploring how the AB system intersects with every facet of hockey operations—this paper not only validates the metrics but also extends their practicality and reach.

Each section of this paper reflects a step forward in refining the metrics, connecting the dots between individual and organizational performance, and presenting actionable insights that were unattainable in the earlier study. As we move forward, this paper serves as a call to action for hockey organizations to embrace data-driven strategies that go beyond traditional metrics. The Advanced Bracton Family of Metrics is no longer just a theoretical framework; it is a proven, evolving system that empowers teams to make smarter, more informed decisions.

Chapter 3 – The Bracton and Advanced Bracton Scores

Initially, my work revolved around the somewhat obvious assumption that mistake minimization wins sporting events, especially hockey games. To my surprise, many organizations have seemingly failed to embrace it, constantly employing players who prove to hinder team success more than help it. This is probably because, as far as I know, no one has been able to accurately measure the essential elements needed to prove this seemingly obvious truth. Until now. My dispassionate and extensive deep dive into calculating intangible decision-making prowess at the individual NHL player level, showed conclusively over 17 years of data sets that not only can intelligence and talent be measured, but each is also a prerequisite to success on the ice.

This statement has been further supported with extremely high confidence intervals of various statistical analyses. Each suggests impressive retrospective veracity as well as modest predictive power, whether it be the application of the Metric to coaching, scouting, player draft results, playoff performance, or merely individual on ice results. My data clearly shows, as the following study presents that teams who maximize their aggregate Advanced Bracton scores win games with regularity, are more likely to qualify for the postseason, and consequently, have a better chance at capturing a Stanley Cup Championship.

Over time, it became evident that the philosophical foundation of HFFA, as embedded by the AB score, is fundamentally sound. Engaging with insights from industry experts and professionals underscored the importance of developing one’s unique strategies or ideology in the game, thereby setting individuals apart from casual fans. This differentiation arises from the remarkable accuracy of retrospective data analysis and its potential applicability in shaping prospective managerial decisions. These ideas were subsequently structured into a proprietary format and have been published over the years. Importantly, the principles clarified herein possess a universal versatility that can be effectively conveyed in a professional context, spanning all levels of the game. Furthermore, this body of research extended beyond the realm of player analysis. It encompassed various industry analysis exercises, including the evaluation of the hockey agency business, financial assessments for all 32 NHL teams, and an in-depth analysis of the NHL arbitration process. Consequently, the study presented serves as an exposition of the underlying philosophy, its resultant findings, and a prelude to the proposition that past experiences often serve as a prologue to future outcomes.

The Advanced Bracton score represents a meaningful quantification of the impact of errors on outcomes of hockey games. Just as there are positive multiplicative effects of multiplying two negatives in mathematics, the same holds true in hockey. As a result, two metrics arose; the first one being the Bracton Score “Bracton”, and the second the “Advanced Bracton Score.” The “Bracton” numerically calculates the positive or negative contribution of a player to his team vis-a-vis mistakes taken or generated via the penalty assessment process. The Bracton Score can also be used when aggregating the ability of an entire team to generate more mistakes from its opponent than it commits. In formulating the “Bracton,” the following assumptions and questions about hockey in general to deduce a numerical conclusion were considered.

- If the only differentiator in a game pitting world class athletes against one another is the combination of skill, intelligence, and the desire to win, can these intangiblesbe measured?

- Through an analysisof the process of taking and drawing penalties, is it possible to partially evaluate these intangibles?

- Assuming players are most often only desperate enough to gain some extra-rule advantage when opposing players are either working harder for the puck, are demonstrating superior skill, or are making more intelligent decisions on or off the puck. Conversely, the players that consistently take minor penaltiesare the ones who are either slower, are being outplayed, are out of position, consistently playing outside the system of the coaching staff, or worse, playing injured. These situations only arise due to an asymmetry of skill, intelligence, desire, injury, or a combination of all four.

- When a team either takes or draws a penalty, the difference between goals produced and goals allowed is far higher in both directions. Therefore, players who possess a positive “Bracton” scoreallow for an additive contribution to the success or failure of a team.

- Players that generate penalties, even if they are normally not on the power play unit, maximize ice time for the assumedly most skilled star players who are on the power play unit. Conversely, and most significantly, players who take more penaltiesthan they draw maximize ice time for opposing premier players. This is because 5×4/60 minutes is much higher than 5×5/60 minutes and of course saves goals by not taking penalties 4×5/60 minutes.

Even though the above points may seem obvious, we must ask ourselves, why hasn’t a metric such as the “Bracton” been either advanced, widely reported, or become a mainstay in hockey for decades, not just in the dawning era of “Moneyball” in hockey? While the “Bracton” is a powerful metric, if not somewhat a priori, it must be understood that it only provides a springboard to its more highly correlated predictive brethren; the Advanced Bracton (AB) Score.

In this proprietary statistic, various data points related to retrospectively positive or negative outcomes within the play of hockey games, aggregated for a season, were compiled within a highly complex formula in order to assign every player a numerical value. These statistics were added to the Bracton score to uncover an even more meaningful quantification of whether a hockey player impacts his team positively or negatively. Unlike the “Bracton”, these results are in no way obvious even though for seasoned hockey enthusiasts and managements they may be intuitive. For example, for someone to say, “I knew Auston Matthews was a good player, but I didn’t really know how good relative to the rest of the league” the AB successfully measures ostensible intangibles that appear to relate to what I term “unscored goals at the margin (UGM).”

By deducing the contribution of a player toward UGM, we can assign an actual value (or in many cases a negative value) players have toward the overall team performance. For example, in the case of Auston Matthews, he scores among the league best AB at 9.66. Under the AB philosophy, in addition to the goals and assists produced by Matthews, he was responsible for another 9.66 goals UGM for Toronto that neither he nor the Leafs scored directly but avoided by either limiting mistakes or being “in the right place at the right time with the right mindset.” In this regard, to earn a 9.66, Matthews undoubtedly had his head in the game, played hard the majority of his shifts, and played within the system employed by Toronto’s coaching staff. As such he is what the sports community terms a “character player.” A character player is not only someone who plays with heart and high energy, but if he is someone who provides UGM, he is possibly worth the money he is being paid to play hockey – a statistic also tracked herein by our proprietary arbitration analyzer (addressed in a later chapter).

In contrast to success stories like Matthews, it was quite surprising at just how many players in the NHL not only produced negative UGM but recorded lower than replacement level production for their respective clubs – a replacement player analysis has recently been completed in the context of the AB metric as well (see later chapter). By virtue of their presence, negative Advanced Bracton players take away UGM and actually cost their team goals, wins, points in the standings and above all, strike the teams’ salary cap with detrimental returns on investment. In fact, it was also striking to note that roughly half of the players in the league could be replaced by a lesser-known talent and possibly have an overall positive impact on the team replacing them. Also, it became apparent that there are some teams in the NHL that use metrics similar to the AB in constructing their teams. Of the teams in the middle of the pack, generally it was concluded that even if they had several high UGM players, their success was muted if they had several in the lowest quintile. Finally, the worst teams in the league are literally loaded with negative UGM Advanced Bracton players with few or no players to counteract them at the top.

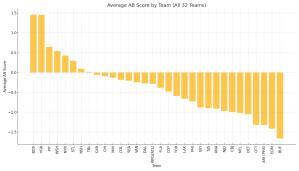

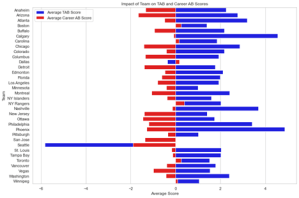

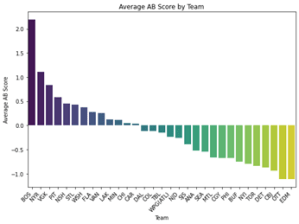

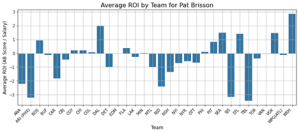

From a general management philosophical standpoint, teams who have adopted or will adopt the Advanced Bracton (or facsimile) method of team construction enjoy more playoff success and longevity than teams who do not. The remainder of this study will demonstrate further analysis into the roster construction of NHL teams since the 2007-08 season, as well as provide more insight to the concepts addressed to this point. The Average AB Score by Team graph below underscores the critical role of constructing rosters that maximize aggregate Advanced Bracton Scores. Teams with consistently high scores, such as the Pittsburgh Penguins, Tampa Bay Lightning, and Colorado Avalanche, demonstrate the competitive advantages of optimizing player contributions to avoid the pitfalls of negative UGM. These organizations excel at identifying talent capable of positively influencing team performance while maintaining roster balance. This focus on maximizing AB Scores not only improves on-ice success but also highlights the financial prudence of avoiding players whose inefficiencies erode team value.

The data also reveals that teams with middling aggregate AB Scores often struggle to capitalize on high-impact players due to a lack of complementary talent. This imbalance is evident in teams like Detroit, Ottawa, and Nashville, where the presence of low-performing players offsets the contributions of their top performers. At the opposite end of the spectrum, teams such as Montreal, Philadelphia, and Anaheim illustrate the consequences of consistently low AB Scores, with rosters often dominated by players who detract from overall performance. By providing a clear visualization of team success relative to AB Scores, the graph reinforces the importance of comprehensive roster management strategies. Again, teams that prioritize positive contributions and eliminate negative impact players position themselves for sustained success, both competitively and financially. This analysis exemplifies the broader implications of the AB Score framework as a cornerstone for effective hockey management.

Chapter 4 – The Evolution of the Advanced Bracton Score (AB)

The Advanced Bracton Score (AB) has undergone a remarkable transformation since its inception, evolving from a straightforward player evaluation metric into a comprehensive analytical framework that supports decision-making across all facets of hockey operations. At its core, the AB Score was initially designed to quantify individual contributions by capturing the essence of a player’s ability to minimize mistakes and maximize impact. Built on principles of intelligence, discipline, and situational awareness, the metric provided a fresh lens through which player performance could be understood. However, as its application expanded, the AB Score matured into a system capable of addressing challenges at every level of hockey—from pre-NHL scouting to agent negotiations and organizational strategy.

In its earliest form, the AB Score focused exclusively on players, utilizing traditional statistics like goals, assists, and penalties to create a single number that reflected net contributions to team success. The initial findings were promising, revealing patterns that linked individual mistake minimization to better team outcomes. Yet, these early iterations lacked the depth needed to capture the complex interplay of roles, contexts, and long-term impacts that define hockey dynamics. Recognizing these limitations, the AB Score was refined and expanded to account for contextual adjustments, role-specific weightings, and dynamic variables such as career longevity and positional specialization.

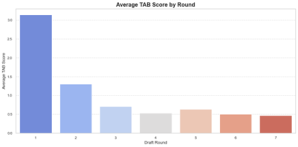

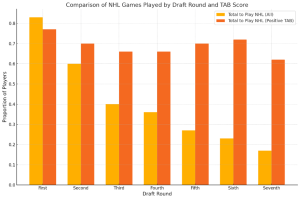

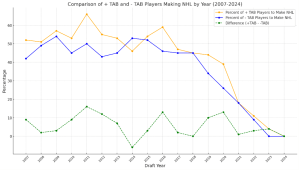

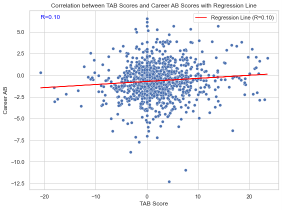

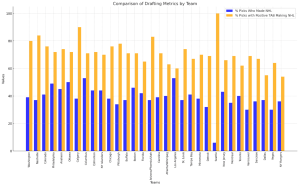

A pivotal development in the AB Score’s evolution was its adaptation for pre-NHL scouting through the introduction of the Tentative AB Score (TAB). While still rooted in the principles of the original AB Score, TAB was designed to assess the early potential of junior players and draft prospects. Although its implementation is still in its early stages, analysis over the 17-year span of NHL data (2007-08 to 2023-24) has begun to highlight its potential value. Preliminary findings suggest that players with higher TAB Scores tend to have stronger long-term NHL success, making it a promising tool for teams seeking to refine their scouting and draft strategies. The TAB metric has shown promise in uncovering patterns that align with successful NHL careers, particularly in evaluating late-round prospects who may otherwise go unnoticed.

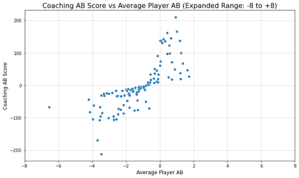

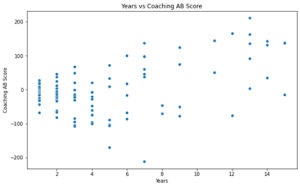

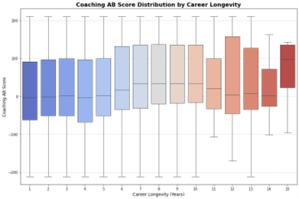

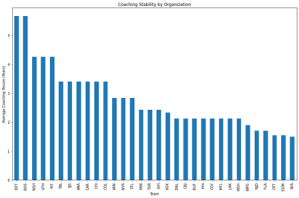

Simultaneously, the AB framework expanded its reach into coaching and management evaluation. The Coaching AB Metric provided insights into how effectively coaches maximized player performance and minimized systemic errors. Findings from the 17-year dataset revealed that teams with high-scoring coaches consistently outperformed their peers in both the regular season and playoffs, underscoring the importance of strategic alignment with AB principles. Similarly, the General Management AB Metric assessed decision-making at the executive level, offering a detailed analysis of roster construction, trade efficiency, and salary cap optimization.

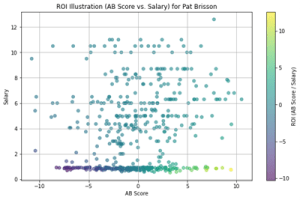

The framework also extended into agent analysis and arbitration, leveraging principles and data similar to those underlying the AB Score to align player performance metrics with market valuations. While the AB Score itself has not been directly employed, agents who incorporate comparable performance metrics into their strategies tend to secure higher average salaries for their clients. By grounding negotiations in objective, data-driven insights, these agents effectively highlight their clients’ value, leading to fairer and more equitable outcomes. This approach benefits both players and teams, ensuring competitive compensation while maintaining financial sustainability across organizations.

This chapter focuses solely on the findings from analyzing the league as a whole, providing a detailed exploration of patterns, trends, and insights uncovered during the evaluation of all NHL players from 2007-08 to 2023-24. By isolating these league-wide results, the chapter serves as a foundation for understanding how the AB framework captures the dynamics of team and player performance at a macro level.

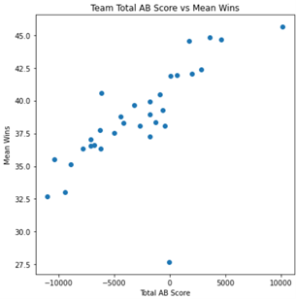

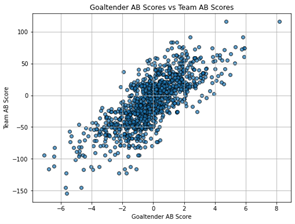

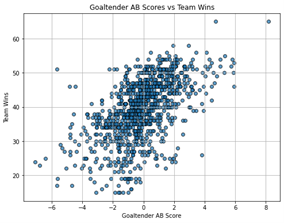

The Relationship Between Team Total AB Score and Mean Wins

The relationship between a team’s Total AB Score and its Mean Wins highlights the AB framework’s predictive ability in evaluating team success. Total AB Score is a cumulative metric, integrating individual player contributions into a holistic team assessment. The total number was calculated by taking each NHL franchises’ final team AB score each season from 2007-08 to 2023-24. Teams with higher Total AB Scores demonstrate a clear advantage in achieving regular-season success, as shown in the scatterplot. The data reveals a statistically significant positive correlation, with a calculated coefficient of 0.78 across all data points. This underscores the reliability of Total AB Scores as a consistent indicator of regular season wins.

The scatterplot provides visual evidence of this relationship. Teams with Total AB Scores above 5,000 consistently achieve mean win totals exceeding 40 games per season, reflecting their ability to sustain success over an 82-game schedule. However, this calculation does include the shortened NHL seasons due to the most recent lockout and the Covid-19 pandemic. Conversely, teams with negative AB Scores struggle to surpass 30 wins, often highlighting deficiencies in roster construction, depth, or systemic alignment. The upward trajectory of the graph emphasizes that the AB framework captures not just individual excellence but also the collective impact of the roster. This highlights how the Total AB Score serves as a comprehensive measure of team efficiency, adaptability, and mistake minimization.

For General Managers, this finding provides a clear directive: roster construction should focus on maximizing Total AB Scores by targeting players who can make sustained, measurable contributions. The goal is not merely to add star players but to build balanced rosters where even role players contribute positively to the team’s Total AB performance. Players with high AB Scores typically excel in mistake minimization, intelligent positioning, and adaptability—traits that directly contribute to sustained team success. By prioritizing such players during drafting, trading, and free-agent signings, GMs can ensure that their rosters are aligned with the principles of mistake minimization and systemic strength.

From a coaching perspective, the Total AB Score has direct implications for maximizing Unscored Goals at the Margin (UGM). UGM captures the subtle, non-scoring contributions that influence game outcomes, such as effective puck retrieval, forechecking, and neutral zone control. Coaches can use AB metrics to make lineup decisions that prioritize players who excel in high-leverage UGM scenarios, such as penalty kills or defending late-game leads. This strategic deployment ensures that every shift contributes to the team’s overarching goal of mistake minimization and efficiency. By aligning ice time with players who consistently perform well in AB metrics, coaches can optimize their team’s ability to control the game and tilt outcomes in their favor.

The retrospective predictability of the AB framework further solidifies its value in analyzing team performance. Spearman’s rho calculations conducted over a 17-season span demonstrated a remarkable alignment between Total AB Scores and final standings. This statistical measure of rank correlation evaluates how well the rankings predicted by Total AB Scores correspond to actual team finishes. Across the dataset, the average rho value was calculated to be 0.85, indicating a strong and consistent relationship between the predicted and actual rankings.

For example, in the 2016-17 NHL season, the top five teams by Total AB Score—such as the Washington Capitals and Pittsburgh Penguins—were accurately reflected among the top five teams in the standings, with a rho value of 0.91 for that season. Similarly, in the 2019-20 season, a challenging year impacted by the COVID-19 pandemic, the AB framework still maintained predictive reliability, achieving a rho value of 0.78, despite the disruptions to scheduling and gameplay.

This analysis highlights the practical applications of the AB framework as a decision-making tool. By retrospectively comparing rankings, teams can validate the effectiveness of their roster construction strategies. Moreover, the consistency of rho values across multiple seasons underscores the AB Score’s ability to transcend anomalies, such as expansion team performances or unexpected roster changes. This level of predictability offers hockey operations a robust framework for refining strategies, not only for future success but also for learning from past outcomes.

In conclusion, the consistently high rho values emphasize the power of AB Scores in capturing the nuances of team performance and rank prediction. Teams can use these insights to assess their standing within the league and identify the adjustments needed to climb the rankings. The correlation between AB Scores and actual standings provides a statistically validated roadmap for teams striving for consistent success in the highly competitive NHL landscape. The relationship between Total AB Score and Mean Wins is a testament to the AB framework’s power to quantify the nuanced dynamics of team performance. By leveraging these metrics to guide roster construction, lineup decisions, and long-term planning, both GMs and coaches can align their strategies with the principles of mistake minimization and systemic optimization.

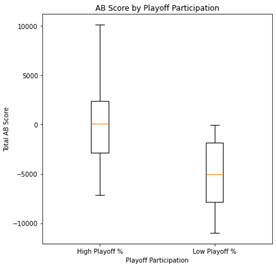

The Relationship Between AB Scores and Playoff Participation

Building upon the correlation between Total AB Scores and regular season wins, the relationship between AB Scores and playoff participation further exemplifies the AB framework’s predictive power. While the regular season provides a broad measure of team consistency, the playoffs demand a higher level of depth, adaptability, and resilience. The box plot illustrates a stark divide between high-playoff-participation teams and their lower-performing counterparts. Teams with greater playoff success consistently boast significantly higher Total AB Scores, reflecting their systemic strength and ability to perform under the unique pressures of postseason hockey.

This distinction underscores the multifaceted nature of playoff hockey, where individual brilliance is often insufficient to secure success. Unlike the regular season, where exceptional performances from star players can carry a team, the playoffs emphasize contributions from the entire roster. Players with high AB Scores, including role players, contribute to mistake minimization, effective puck management, and situational awareness—qualities that are critical in the high-stakes environment of the playoffs. Teams with lower Total AB Scores frequently lack the depth required to withstand the inevitable challenges of postseason play, such as injuries, tactical adjustments, and heightened pressure.

Notably, data from the study reveals that the team with the higher Total AB Score in the Stanley Cup Final ended up winning it in all but six years of the 17-season period analyzed. This finding reinforces the importance of systemic strength over individual talent in achieving ultimate success. It also highlights the AB framework’s ability to identify teams that are not only playoff-ready but championship-caliber. The two exceptions underscore the unpredictable nature of hockey but also serve as outliers that prove the rule: teams with higher AB Scores are overwhelmingly more likely to achieve postseason success.

For teams on the playoff bubble, these insights are particularly valuable. By targeting improvements in their Total AB Scores, either through strategic acquisitions or player development initiatives, these teams can shift from mediocrity to playoff contention. Importantly, GMs can achieve significant gains not only by adding high-performing players but also through subtraction—replacing below-replacement-level players with players performing at a baseline level. This incremental improvement, though seemingly minor, can yield substantial benefits in Total AB Score and overall team performance. Such moves are especially critical for teams struggling with depth issues, where upgrading even marginal contributors can have a cascading positive effect on roster efficiency.

The AB framework also provides a lens for understanding why certain teams consistently excel in the playoffs. High-playoff-participation teams often exhibit balanced rosters with few weak links, enabling them to mitigate the risks associated with the intensity of playoff hockey. These teams demonstrate a clear advantage in systemic strength, as reflected in their Total AB Scores, which translates into greater resilience and adaptability in high-pressure scenarios. By maintaining a roster that consistently performs above the league average in AB metrics, these teams position themselves for sustained postseason success.

The box plot further emphasizes the systemic disparities between playoff contenders and non-contenders. Teams with high playoff participation rates typically maintain Total AB Scores well above the league median, while those with minimal playoff appearances are clustered below it. This visualization reinforces the predictive validity of AB metrics, illustrating how Total AB Scores serve as a benchmark for postseason readiness.

In conclusion, the correlation between AB Scores and playoff participation highlights the systemic qualities required for success in the NHL playoffs. By leveraging AB metrics to inform roster adjustments and strategic planning, teams can enhance their ability to compete in the postseason. The fact that the higher AB Score team has won the Stanley Cup Finals in all, but six years of the study further validates the framework’s power to identify championship-level teams. Coaches and general managers alike can use this insight to identify the adjustments necessary to transition from regular-season consistency to playoff dominance.

Total AB Scores vs. Wins with Team Logos

The scatterplot comparing Total AB Scores to total wins over a 17-year period provides a comprehensive lens through which to examine the relationship between roster composition and long-term success. By incorporating team logos into the visualization, the chart offers immediate clarity, highlighting key outliers while drawing attention to overall trends. Teams such as the Boston Bruins and Vegas Golden Knights emerge as examples of success stories, showcasing high Total AB Scores that align with substantial win totals. These franchises reflect the hallmarks of organizational consistency, including strong player pipelines, strategic roster construction, and effective coaching.

As recent expansion franchises, both the Kraken and Vegas Golden Knights lack the sample size to match the consistency and depth of data available for more established teams. Seattle, in particular, is still in the early stages of constructing a competitive roster, reflected in their lower Total AB Scores and corresponding win totals. These circumstances highlight the limitations of short-term planning, and the inherent difficulties expansion teams face in achieving league-wide parity. In contrast, Vegas, despite their expansion status, benefits from a highly strategic approach to roster building, resulting in a higher Total AB Score than typical for teams at a similar stage.

The strength of the relationship between Total AB Scores and total wins becomes even clearer when statistical outliers are removed. Initial calculations yield a correlation coefficient of 0.1522, indicating a modest relationship when all data points are included. However, refinement of the dataset by excluding certain outliers significantly enhances the correlation. For instance:

- Excluding Seattle, Vegas, and Boston increases the correlation coefficient to 0.9205.

- When only Seattle and Vegas are excluded, the correlation improves even further to 0.9280.

These adjustments validate the robustness of the AB framework while demonstrating its sensitivity to outlier effects. Removing these anomalies provides a more accurate representation of how roster composition, as captured by Total AB Scores, directly influences team success. This underscores the importance of context when interpreting league-wide trends, ensuring that data is appropriately framed to account for unique circumstances like smaller sample sizes or extraordinary dominance.

From an operational standpoint, this graph underscores the critical role of long-term planning and organizational consistency. Teams with high Total AB Scores frequently benefit from cohesive strategies across all levels of hockey operations, including drafting, development, and player retention. In contrast, franchises with persistently low AB Scores often struggle due to fragmented approaches, insufficient player pipelines, or ineffective leadership. By leveraging the insights provided by AB metrics, these teams can identify specific areas for improvement and implement data-driven strategies to optimize roster performance.

The correlation analysis also highlights the potential for GMs to use Total AB Scores as a benchmark for evaluating their progress. By targeting incremental improvements in AB Scores—such as replacing below-replacement-level players with baseline contributors—teams can steadily increase their win totals over time. This approach ensures that even marginal gains in roster construction can compound into significant long-term benefits.

In conclusion, the scatterplot and its refined correlation analysis highlight the predictive strength of the AB framework in understanding team success. While accounting for outliers is essential to contextualize trends, the underlying relationship between Total AB Scores and total wins remains clear and actionable. The graph above visually reinforces the importance of sustained roster quality in achieving long-term competitiveness, offering hockey organizations a reliable roadmap for future success.

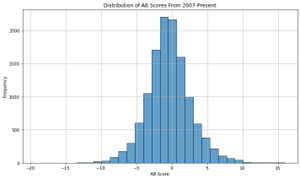

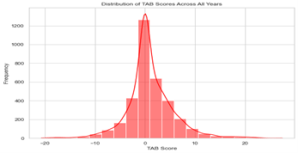

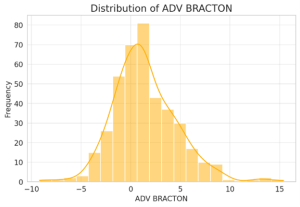

Distribution of AB Scores

The histogram of AB Scores provides a detailed examination of player performance across the NHL during the 17-year study period. The near-normal distribution observed in the graph highlights a key insight: most players perform close to replacement level, clustering around a baseline score near zero. This distribution reflects the consistent spread of talent across the league and demonstrates the efficacy of the AB framework in capturing subtle differences in player performance. The high concentration of players near zero indicates a league-wide emphasis on building rosters with contributors who can reliably meet minimum expectations, though the scarcity of players with exceptional AB Scores points to the value of identifying and retaining standout performers.

High-AB players whose scores significantly exceed the replacement level—represent a small but impactful group. These individuals are pivotal to team success because they contribute well beyond baseline expectations in areas such as situational awareness, mistake minimization, and game-changing plays at critical moments. For example, forwards with high AB Scores may excel in creating scoring opportunities through disciplined puck management and timely assists, while defensemen with similar scores can consistently suppress high-danger chances and lead transition plays. These players often form the backbone of championship-level rosters, providing consistency and leadership that elevates overall team performance.

Conversely, players with persistently low AB Scores present tangible challenges for their teams. Their inability to meet replacement-level contributions may stem from repeated mistakes, poor positional awareness, or inefficiencies in execution. The histogram’s lower tail, representing these underperformers, underscores the importance of roster management decisions focused on either improving their play or replacing them entirely. For instance, teams struggling with depth issues on their bottom-six forwards or third-pairing defensemen can use AB metrics to identify specific players whose removal or improvement could significantly impact team results.

The symmetry of the histogram validates the AB framework’s design, particularly its ability to evaluate players across all positions and roles without systemic bias. This feature is critical for ensuring that metrics derived from the AB framework are applicable league-wide, allowing general managers to compare players with vastly different responsibilities, such as a scoring winger versus a stay-at-home defenseman. Additionally, the normal distribution supports the reliability of the metric for modeling and predictive analysis, ensuring that the AB framework can function as both a diagnostic and planning tool for hockey organizations.

Another key takeaway from the histogram is the sharp decline in frequency at the positive end of the distribution, where truly elite players are found. This rarity of high-AB players illustrates the competitive advantage held by teams capable of identifying and developing these individuals. For example, the histogram may show that fewer than 10% of players achieve AB Scores exceeding five, yet these players often account for a disproportionate share of team success. The ability to identify such talent through scouting and data analysis can enable teams to maintain consistent playoff contention and reduce reliance on volatile free agency markets.

The histogram also provides actionable insights for roster construction. For teams consistently finishing below the league median in Total AB Scores, the distribution serves as a diagnostic tool to identify inefficiencies. For example, a team with a significant cluster of low-AB players in their roster can use the framework to determine whether specific positions, lines, or even individual players are contributing to their underperformance. General Managers can then address these gaps through strategic acquisitions, player development programs, or roster turnover.

In conclusion, the graph provides an invaluable visual representation of the AB framework’s ability to quantify player performance across the league. The insights gained from the distribution not only validate the robustness of the AB metric but also emphasize the importance of retaining high-AB talent and addressing low-AB liabilities. By leveraging these findings, teams can ensure that their roster-building strategies are grounded in data, maximizing both short-term competitiveness and long-term sustainability.

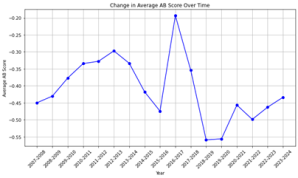

Change in Average AB Score Over Time

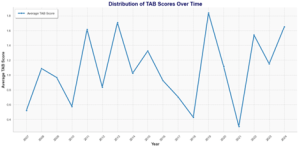

The line graph illustrating changes in average AB Scores over time reveals valuable trends in league-wide performance and highlights the impact of external factors on player development. By examining these fluctuations, we gain a deeper understanding of how systemic changes in the NHL influence player contributions and team success.

A particularly notable feature of the graph is the pronounced spike during the 2016-17 season. This increase likely reflects a league-wide shift toward prioritizing skill and speed, driven by tactical adjustments and an influx of young, dynamic talent. For example, this period coincided with the emergence of high-impact rookies and a growing emphasis on high-tempo, possession-based hockey. The AB framework captures this transformation by quantifying the rise in player efficiency and adaptability during this time, offering a reliable measure of how these systemic changes affected overall performance.

Conversely, the sharp dip observed during the 2019-20 season aligns with the disruptions caused by the COVID-19 pandemic. The pandemic introduced unprecedented challenges to the league, from interrupted training schedules to condensed seasons and altered competitive dynamics. These factors likely contributed to a decline in player readiness and performance, as reflected in the drop in average AB Scores. The graph underscores how external pressures can significantly impact league-wide trends, providing a quantifiable measure of how the pandemic disrupted player output on a macro scale.

The subsequent recovery in AB Scores over the following seasons highlights the adaptability and resilience of both players and organizations. Teams that demonstrated strong player pipelines and robust developmental systems were better equipped to rebound from these disruptions, maintaining higher AB Scores even during periods of league-wide uncertainty. For example, organizations with well-established scouting and development programs were able to minimize the long-term effects of the pandemic by quickly integrating emerging talent and supporting their rosters through adversity. By analyzing how different franchises performed during this period, we can identify which organizational strategies translated into sustained success despite external challenges.

The graph also offers valuable lessons for future planning. As the league continues to evolve tactically and structurally, tracking changes in average AB Scores can serve as a predictive tool for identifying emerging trends. For example, if a future season were to exhibit a similar spike in AB Scores, it might indicate another shift in league dynamics—such as a new emphasis on speed, defensive structure, or goaltending efficiency. Teams that monitor these fluctuations and align their strategies accordingly will gain a competitive edge.

Moreover, the data underscores the value of long-term investment in youth development. Teams that consistently produce high-AB talent through their development systems are better positioned to navigate periods of disruption and capitalize on shifts in league-wide trends. This reinforces the importance of strong scouting networks and a commitment to nurturing young players, not just as a response to immediate challenges but as a strategy for sustained success.

In conclusion, the line graph of average AB Scores over time illustrates the ability of the AB framework to capture both individual and systemic changes in the NHL. By reflecting the impact of external events, such as the COVID-19 pandemic, and internal shifts, like the 2016-17 focus on speed and skill, the graph provides a dynamic view of league trends. For organizations, this insight underscores the importance of adaptability, consistency in player development, and a forward-looking approach to roster construction. The graph serves as a powerful reminder of how external factors and league dynamics shape player performance and organizational success.

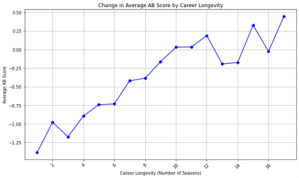

Change in Average AB Score by Career Longevity

The line graph titled Change in Average AB Score by Career Longevity, highlights a critical relationship between career longevity and player performance as measured by AB Scores. The upward trend in the graph shows that players who remain in the NHL longer tend to achieve higher AB Scores, reinforcing the framework’s ability to capture the qualities necessary for sustained success. This trend is particularly significant in understanding how consistency, adaptability, and mistake minimization shape a player’s career trajectory.

Early in their careers, many players exhibit lower AB Scores as they adjust to the speed, physicality, and strategic demands of the NHL. Rookies and younger players are more likely to make mistakes or struggle with decision-making under pressure, which is reflected in their initial AB metrics. However, players who can steadily improve their AB Scores over time often emerge as reliable contributors, capable of positively influencing team performance. This progression underscores the value of long-term investment in player development, as organizations that successfully nurture high-potential talent are rewarded with consistent, impactful performances.

The graph also reveals that AB Scores plateau for players nearing the later stages of their careers. While veterans bring invaluable experience and leadership to a roster, the data suggests diminishing returns in terms of on-ice performance as they approach their performance ceiling. For teams, this plateau emphasizes the importance of balancing the presence of veteran players with the infusion of youthful energy. Younger players, even if initially less impactful, represent opportunities for growth and long-term contributions, provided they are developed effectively.

One of the key takeaways from this analysis is the importance of identifying young players with high potential AB Scores. Teams that excel at scouting and developing such players gain a significant competitive advantage, as these individuals are more likely to achieve sustained success and provide a high return on investment. For example, a young forward with a relatively low AB Score but consistent year-over-year improvement may be a better long-term investment than a veteran nearing their peak but unlikely to improve further. This perspective highlights how AB metrics can serve as a tool for managing expectations and maximizing player value at different career stages.

The graph also has important implications for contract negotiations and roster planning. AB Scores can help teams evaluate a player’s career trajectory, ensuring that their financial commitments align with expected contributions. By prioritizing players who demonstrate sustained improvement in their AB metrics, organizations can minimize the risk of overpaying for declining veterans or undervaluing emerging talent. For instance, a defenseman whose AB Score steadily improves over the first five years of their career may warrant a long-term contract, as their development trajectory suggests continued contributions.

Moreover, the data highlights the potential risks associated with relying too heavily on veterans whose performance has plateaued. While these players bring intangible qualities such as leadership and experience, teams must ensure that their financial and roster commitments remain proportional to their on-ice impact. AB Scores provide a quantifiable metric to guide these decisions, helping teams strike the right balance between veteran presence and the integration of younger, high-potential players.

In conclusion, the graph demonstrates how the AB framework provides a nuanced understanding of player performance over the course of their careers. By capturing the upward trend in AB Scores as players gain experience, the graph underscores the importance of long-term player development, strategic roster planning, and data-driven decision-making. Teams that leverage these insights are better positioned to build rosters that combine youthful potential with veteran reliability, ensuring both immediate competitiveness and sustained success in the NHL.

Conclusion of Chapter 4: The Evolution of the Advanced Bracton Score (AB)

Chapter 4 chronicles the Advanced Bracton Score’s (AB) progression from an individual player evaluation metric to a comprehensive framework that supports decision-making across all facets of hockey operations. Building upon the foundational principles of mistake minimization and situational awareness outlined in earlier research, the AB framework has evolved to address systemic team dynamics, offering a holistic view of roster construction, coaching strategies, and long-term planning.

The relationship between Total AB Scores and regular season wins highlights the framework’s capacity to translate individual contributions into team success. Retrospective analyses, such as Spearman’s rho values, further validate the AB Score’s predictive power in correlating Total AB Scores with league standings over a 17-year span. These findings reinforce the framework’s ability to adapt to both individual and team-level contexts, offering practical insights for building competitive rosters.

Insights into career longevity and systemic disruptions demonstrate the framework’s adaptability to evolving circumstances. The upward trend in AB Scores with career longevity underscores the value of sustained development, while fluctuations in league-wide averages during key periods, like the COVID-19 pandemic, reveal the framework’s ability to capture external impacts on performance. These advancements reflect natural progression from the AB Score’s early iterations, expanding its scope to address broader organizational challenges.

This evolution mirrors the iterative process of the research itself, with each refinement bringing greater clarity and utility. As the foundation of this study, Chapter 4 sets the stage for deeper explorations into specific applications of the AB framework in the chapters to come.

Chapter 5 – Replacement Level Player Analysis

The concept of a Replacement Level Player (RLP) is foundational to evaluating team construction in hockey. RLP metrics establish a baseline for assessing player contributions, providing a critical reference point for understanding value above or below replacement. This chapter explores the calculation of RLP metrics, trends over time, and their implications for team success, supported by insights derived from Advanced Bracton (AB) Score data.

Defining Replacement Level Player Metrics

Replacement Level Player (RLP) metrics are designed to establish a baseline for assessing the minimum performance threshold that a readily available player must achieve to warrant inclusion in a roster. This benchmark enables teams to identify players whose contributions meet or exceed expectations, as well as those who may hinder overall team success. Calculating this baseline requires a combination of historical averages and adjustments for outliers to ensure that the metric remains robust and reflective of real-world scenarios. By doing so, RLP metrics account for both systemic league-wide trends and positional nuances.

The AB Score is foundational to this evaluation, serving as a comprehensive tool for quantifying player performance across key dimensions such as skill, mistake minimization, and team impact. It facilitates granular analysis, enabling comparisons within and across positions. Forwards, defensemen, and goaltenders are analyzed independently due to the distinct nature of their roles and responsibilities on the ice. Forwards are assessed for their offensive output and ability to influence scoring margins, while defensemen are measured by their contributions to zone control, mistake minimization, and transitional play. Goaltenders present unique challenges due to the variability in their performance metrics, necessitating additional considerations when establishing replacement-level thresholds.

Historical AB Scores provide a longitudinal perspective, illustrating how the definition of replacement level has evolved in response to shifts in game strategies, talent pools, and league-wide trends. For instance, the increasing reliance on puck-moving defensemen in recent years has raised the average replacement-level baseline for this position. Similarly, changes in offensive depth and special teams strategies have influenced replacement-level benchmarks for forwards. These dynamic shifts emphasize the importance of contextual analysis when evaluating players, as what constitutes replacement-level performance is not static but rather a reflection of the game’s ongoing evolution.

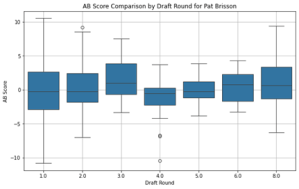

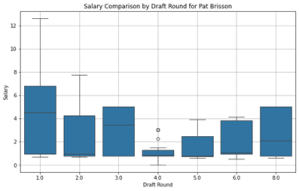

The findings in Chapter 4 underscored the negligible correlation between draft position and AB Score performance, highlighting the limitations of traditional evaluation methods that rely heavily on draft status as a proxy for potential. Replacement-level metrics address this gap by focusing on actual contributions rather than perceived potential. By providing a data-driven framework for assessing player value, RLP metrics allow teams to make more informed decisions about roster construction, player development, and resource allocation.

Additionally, RLP metrics enable teams to evaluate the opportunity cost of retaining below-replacement players versus exploring alternatives. This is particularly relevant in the context of salary cap management, where teams must balance the cost of players against their on-ice contributions. The integration of RLP metrics with advanced analytics, such as CABAR and ABAR (Career and Advanced Bracton Above Replacement), further strengthens this framework, offering a multi-dimensional approach to assessing value. These insights are invaluable for identifying undervalued players, optimizing roster efficiency, and maximizing overall team performance.

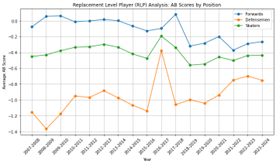

Trends in AB Scores by Position

An analysis of average AB Scores by position over time uncovers significant trends that highlight the evolving dynamics of hockey and the distinct contributions of each positional group. Forwards consistently display higher average AB Scores compared to defensemen, reflecting their critical role in driving offensive production and influencing scoring margins. This trend underscores the centrality of forwards in determining team success, particularly through their ability to generate and capitalize on scoring opportunities. Moreover, the rise of versatile forwards who contribute to both ends of the ice has further elevated the expectations and standards for replacement-level performance in this position.

Conversely, defensemen, while contributing less directly to offensive outcomes, excel in metrics related to zone control, mistake minimization, and transitional play. These contributions, though less immediately visible, are integral to overall team stability. The influx of elite talent at the position, such as Cale Makar, Adam Fox, and Roman Josi, reflects a broader league-wide shift toward valuing defensemen who can effectively transition the puck while maintaining defensive responsibilities. This evolution has reshaped the baseline for replacement-level performance, with modern defensemen expected to contribute significantly to both defensive structure and offensive facilitation.

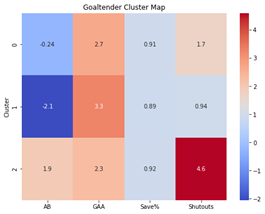

Goaltenders, however, present unique challenges in Replacement Level Player (RLP) analysis due to the high variability inherent in their performance metrics. A single outstanding season or a particularly poor performance can disproportionately impact averages, making it difficult to establish consistent benchmarks. The variability in goaltender AB Scores is further influenced by factors such as team defensive systems, quality of opposition, and overall workload. For example, goaltenders playing behind strong defensive cores often achieve higher Save Percentages and lower Goals Against Averages, indirectly boosting their AB Scores.

The context in which goaltenders operate is critical to understanding their contribution relative to replacement level. A goaltender’s performance is deeply intertwined with the team’s defensive strategies, such as shot suppression and rebound control, which can mitigate or amplify their individual impact. This variability necessitates careful adjustments when defining replacement-level thresholds for goaltenders, particularly in multi-year analyses. Additionally, the advent of advanced metrics, such as adjusted save percentages and high-danger save rates, has provided a more nuanced view of goaltender performance, enabling better differentiation between below-replacement and above-replacement players.

These positional differences underscore the importance of tailoring RLP analysis to the unique demands and contributions of each role. The evolution of replacement-level baselines over time reflects broader changes in league dynamics, player development, and team strategies, all of which must be considered when assessing player value and roster construction.

Evolution of Replacement Level Metrics

Over 17 NHL seasons, replacement-level averages have undergone noteworthy changes, particularly in forwards and defensemen, as depicted in the graph. The RLP average for defensemen improved by 13.8%, a remarkable trend influenced by the influx of elite, multi-dimensional defensemen such as Victor Hedman, Roman Josi, Adam Fox, and Cale Makar as mentioned on the previous page. Despite their extensive ice time and higher exposure to potential errors, defensemen have shown a consistent improvement in their ability to positively impact team outcomes.

Forwards also demonstrate an upward trajectory in AB Scores over the study period, underscoring their increasing role in driving offensive depth and generating balanced scoring opportunities. This trend aligns with a league-wide emphasis on dynamic offensive strategies, where even third- and fourth-line forwards are expected to contribute meaningfully. Teams have prioritized developing forwards who excel in creating scoring chances, avoiding penalties, and maintaining possession, leading to higher replacement-level baselines for this position.

Interestingly, while both forwards and defensemen have shown improvement, their RLP averages remain slightly negative throughout the study period. This challenges the theoretical expectation that replacement-level performance would hover around zero. Instead, it underscores the significant value brought by players who perform even marginally above replacement level. Such players often provide intangible benefits, such as strong hockey IQ, adaptability to team systems, and consistent effort, which contribute to team success beyond traditional statistical measures.

The graph below also reveals notable fluctuations in AB Scores, particularly for defensemen. The spike during the 2016-2017 season suggests an anomaly, potentially linked to rule changes, league-wide strategic shifts, or the emergence of standout performances in that year. By contrast, forwards exhibit a steadier upward trend, reflecting the gradual evolution of their role in modern hockey as previously discussed.

For skaters as a whole, the graph highlights a narrowing gap in AB Scores between forwards and defensemen over time. This trend points to league-wide improvements in player development systems, scouting accuracy, and roster construction strategies. The graph also reinforces the importance of analyzing replacement-level contributions within the context of team strategies and league-wide trends. The incremental improvements in AB Scores over time demonstrate how systemic changes in coaching philosophies, player development, and analytics integration have elevated the baseline performance of players across all positions. This evolution not only highlights the growing sophistication of hockey management but also underscores the value of using metrics like the AB Score to refine roster construction and maximize competitive advantages.

In conclusion, the graph offers a comprehensive view of the progression of RLP metrics over time. It illustrates how advancements in player development, strategic adjustments, and the emergence of elite talent have collectively driven improvements in AB Scores across positions. These insights reinforce the critical role of above-replacement-level players in achieving sustained team success and the importance of leveraging analytics to uncover and maximize their contributions.

Career Advanced Bracton Above Replacement (CABAR)

Expanding upon the RLP (Replacement Level Player) framework, Career Advanced Bracton Above Replacement (CABAR) serves as a cumulative measure of a player’s contributions above replacement level throughout their career. Unlike single-season evaluations that provide a snapshot of player performance, CABAR aggregates Advanced Bracton Above Replacement (ABAR) scores across multiple seasons, offering a longitudinal view of a player’s sustained impact. This cumulative approach allows for a more comprehensive assessment of a player’s value, emphasizing consistency and durability as key factors in determining long-term success.

The significance of CABAR lies in its ability to differentiate between short-term peak performers and players with sustained excellence. Many players may have a single breakout season where they exceed replacement level, but only a small percentage consistently maintain a high ABAR across multiple seasons. The fact that only 42% of players analyzed in the 17-year study had positive CABARs reinforces just how difficult it is to remain above replacement level for an extended period. Additionally, the 47% of players who exceeded the replacement-level skater average suggest that nearly half of all NHL players provide at least some value above the league’s replacement threshold, but only a select group truly separates themselves as elite contributors.

The top CABAR performers—Patrice Bergeron (+95.71), Brad Marchand (+73.53), and Pavel Datsyuk (+70.76)—underscore the exceptional impact of players who not only contribute above replacement level but do so over prolonged careers. These players exemplify the ability to maximize team success through mistake minimization, high hockey intelligence, and adaptability to different playing styles and team systems. Bergeron’s two-way dominance, Marchand’s elite transition play and special teams impact, and Datsyuk’s ability to control puck possession and defensive contributions highlight why they consistently maintained high CABAR values. Their longevity and ability to sustain high-impact play across multiple eras of NHL hockey showcase the true value of CABAR as a metric for measuring all-time greats versus transient contributors.

One of the most revealing insights from CABAR analysis is the disparity between players who exceed replacement thresholds early in their careers versus those who build upon their ABAR gradually over time. Some high-performing rookies burst onto the scene with strong AB Scores but fail to maintain those levels due to injuries, diminishing skills, or system changes. Conversely, elite players with high CABAR tend to show a pattern of gradual and sustained growth, adapting their playstyle to remain effective even as they age. This is particularly evident in defensive-minded forwards and elite playmakers, whose ability to think the game at a high level allows them to remain above replacement level long after their physical prime.

The rarity of high CABAR players also suggests a major inefficiency in roster construction, particularly for teams that rely too heavily on replacement-level skaters instead of prioritizing players with sustained AB contributions. Since high-CABAR players demonstrate prolonged effectiveness, GMs who successfully identify and retain such players often build more stable, consistently competitive rosters. This aligns with Stanley Cup-winning team trends, where rosters featuring multiple high-CABAR players significantly outperform those relying on short-term peak performers.

Ultimately, CABAR serves as an indispensable tool for evaluating player value beyond surface-level statistics like goals and assists. By considering a player’s impact over their entire career, CABAR ensures that team decision-makers can prioritize long-term excellence over short-term gains, identifying the players who truly drive success at the highest levels of hockey.

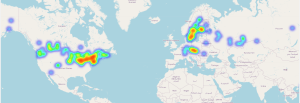

High-Performing vs. Low-Performing Teams

To further understand the impact of Replacement Level Players on team success, an analysis comparing high-performing playoff teams to low-performing non-playoff teams was conducted. The heatmap serves as a visual representation of team-level performance across the NHL from 2007 to 2024, comparing aggregate Advanced Bracton (AB) Scores to replacement-level baselines. Each cell reflects how cumulative AB Score compares to the theoretical performance of a roster composed entirely of replacement-level players. Red tones signify teams exceeding replacement levels, indicating strong roster construction and player contributions, while blue tones represent teams falling below replacement thresholds, often highlighting inefficiencies and underperformance. The horizontal axis corresponds to NHL teams, while the vertical axis spans seasons, enabling the identification of trends over time. This format provides a holistic view of league-wide dynamics, showcasing periods of dominance, parity, and rebuilding phases. The heatmap’s color intensity offers immediate insights into relative team success, with deeper reds and blues illustrating extremes of performance. By combining quantitative data with intuitive visualization, the heatmap becomes an essential tool for understanding the impact of replacement-level analysis in team construction. Its application extends beyond identifying strong and weak teams, revealing broader league trends, such as the influence of analytics, talent distribution, and competitive balance. This comprehensive perspective highlights the critical role of replacement-level metrics in shaping NHL performance and strategies.